Russia invaded Ukraine on 24th February 2022. The two nations have a long and inter-linked history. Their separation after the collapse of the Soviet Union led to the creation of an independent Ukraine.

In response to Russia’s aggression against Ukraine, the West led by the US and the EU has declared financial sanctions on the Russian economy including the “oligarchs” that the West alleges to have close ties with President Putin. Russian business, travel, and even cultural products have been sanctioned. Most notably Russia has been excluded from using the international money transfer system SWIFT. Effectively Russia has been isolated from the international financial system.

It is not the intention here to discuss those issues and factors that led to Russia declaring war on Ukraine. The geopolitical and military consequences are also not discussed here as they require a much lengthier discussion

Here we look at the consequences of a local war that will continue to have consequences well beyond its borders. This piece focuses on the economic repercussions of the war in Ukraine and a sanctioned Russia on developed and developing countries, in particular the changes that will be felt in the gas and oil markets and the potential hazards of a fall in the global wheat supply, especially on the Muslim world. We then discuss some of the other impacts of the war and the potential responses it could foster from the Muslim world.

The Russian Economy

Russia is the world’s largest natural gas exporter and second-largest natural gas producer. It is also the second-largest oil producer and exporter. Its economy heavily depends on natural gas and oil, constituting around 40% of its federal budget revenue and 60% of its total exports. Nevertheless, its economy is less than 2% of the world’s GDP. Considering its natural resources, Russia is a relatively small economy. Even Germany, whose population is half that of Russia’s, has a higher GDP. Or in comparison with Italy which has a smaller population and fewer natural resources, Russia’s GDP is lower. Even Poland exports more to the European Union than Russia.

Russia is one of the EU’s main trading partners. In 2021, Russia was the EU’s fifth-largest trade partner making up 5.8% of the EU’s total trade. Total trade between the two had reached 258 billion euros in 2021 out of which about 158 billion euros was spent on the EU’s fuel and mineral products. The EU exported around 100 billion dollars of goods, which mainly consisted of machinery and equipment, motor vehicles, pharmaceuticals, electrical machinery, and plastics. The EU also happens to be Russia’s biggest trade partner. In 2020, 36.5% of Russia’s total imports came from the EU and 37.9% of its exports were sent to the EU. Foreign direct investment of the EU to Russia was over 310 billion euros in 2019 and Russia’s FDI to the EU was around 135 billion euros. Thus, Russia and the EU are economically interdependent; however, Russia’s gas and oil resources and the EU’s dependence on these give Russia significant political leverage on gas and oil reserves. President Putin’s recent decision to sell oil only in roubles to those who he labels as the ‘unfriendly countries’ is a clear example of Russia’s dominance of the oil and gas market.

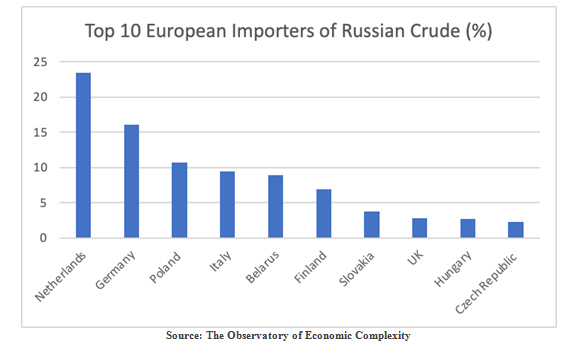

Europe gets 40% of its natural gas and 25% of its oil from Russia. The chart below illustrates the top 10 European importers of Russian petroleum oils, oils from bituminous minerals, and crude which is the first most traded product in the world. Out of the global total trade volume of 640 billion dollars, Russia exports 74.4 billion dollars (11.4%) as the second-largest exporter after Saudi Arabia. The biggest share of its oil exports (32%) goes to China.

Soaring energy prices and inflation are expected to damage European economies more than they do the US, since Russian imports constitute less than 8% of the US’ total energy imports.

Economic Sanctions on Russia and their Consequences

Starting from the first day of the invasion, the US, UK, and the EU announced sanctions on Russia. They first froze Russia’s foreign assets and those of the super-rich who it is alleged have close relationships with the current Russian regime, including Roman Abramovich, the owner of Chelsea Football Club in England.

After freezing Russian owned assets, Russia was banned from the SWIFT (The Society for Worldwide Interbank Financial Telecommunication) system, which more than 24,000 institutions use to ease transactions between bank transfers. Although this could have been an important step to completely isolate the Russian economy from the world market, Germany which depends on Russian energy did not want to remove some Russian banks from the SWIFT system, perhaps because of their dependency on crude oil and gas. Thus, only seven Russian banks in total have been excluded from SWIFT.

The US and its allies put sanctions on Russia’s sovereign debt, namely on the banking assets of the two largest Russian banks, Sberbank and VTB, which hold 50% of the banking assets in Russia. They also sanctioned Russia’s tech exports. At the end of the first week of the invasion, the foreign holdings of Russia that had become frozen reached a trillion dollars. Much of this came with oil and gas price hikes in the market. After the first week of the invasion, the Brent crude oil price jumped to $131 per barrel, which was the highest rate since the beginning of the pandemic. It is currently around $100 per barrel.

Furthermore, Germany has halted the Nord Stream 2 project which aimed to increase Russian gas supply to Europe and lower costs. Although it was criticised by the EU and US due to its potential geopolitical risks in the region, the 11 billion dollars project was completed and waiting for the final certification and approval of Germany. The freeze was welcomed by the US authorities and showed Germany’s resolve to end the invasion immediately. After a week of sanctions, the owner of the Nord Stream 2, half owned by the Russian company Gazprom, decided to apply for insolvency.

The world economy was about to re-emerge from the influences of the COVID pandemic. Most countries’ economies around the world were already suffering due to the pandemic. There is already a global supply chain reduction on many key products. This already led to price rises and inflationary pressures. The war in Ukraine and the sanctions on Russia have aggravated existing uncertainties, especially for the developing world, which depends on Russian oil, natural gas, and agricultural products. This could be the reason that most developed countries and regions (e.g. The US, UK, EU, Switzerland, Australia, Japan, and Taiwan) have sanctioned Russia whereas the developing world has not put any sanctions due to their dependence on Russian commodities like oil, gas, military support and/or agricultural product trades, but also for political reasons. This may not hold however for the likes of China, India, and Turkey, who may be avoiding sanctions for economic reasons but also who are being pressured by Western countries to do so.

The Economic Impact of the War on Global North Countries

One of the negative impacts of this war will be on commodity prices because of supply chain issues and infrastructural damage. These will dampen the macroeconomic conditions of the world and induce central banks to adopt a contractionary monetary policy (increasing interest rates) earlier than they would want to. Considering the inflation rates of 7.9%, 5.5%, and 5.8% respectively in the US, UK, and Euro-zone, the highest of the last four decades, the Russian invasion will worsen inflation levels. Therefore, central banks will take precautionary steps to curb inflation. Even though some central banks, including the FED, see current inflation rates as temporary due to stimulus payments that have been paid to individuals and firms to boost demand and consumption in order not to spur growth, central banks might have to increase the interest rates sooner. In fact, FED has already started rate hiking in the last Federal Open Market Committee (FOMC) meeting.

Moreover, stock markets have plummeted since the invasion started. US, UK, German, Italian, and French stock markets have lost value but expectedly not to the extent of the Russian stock market which was closed until 18th March. The Russian currency, rouble, has plummeted against the US dollar by around 30% since the war broke out. As a consequence, the Russian central bank increased interest rates from 9.5% to 20%. As mentioned previously, the per-barrel price has been swinging around 110$ recently. Nonetheless, if the war becomes more severe and Russia cuts the gas per barrel, the price of oil might go up to 240$ in the summer, according to some projections. With that, Germany, Italy, and other European countries will further suffer.

The effect of increased energy prices, interest rate increases, higher inflation along with supply chain shortages will be much higher prices for businesses and consumers. This will lead to pain and an increase in poverty and debt, especially for the less well off. In turn this could spiral into a recession across Europe, and ultimately political instability.

Consequences on Global South Countries – Oil and Gas Market

Although this war will affect the US and particularly Europe, developing nations will also be affected disproportionately. This is due to their dependence on energy and agricultural products, according to Paul Krugman, Nobel laureate in Economics. The economic harm comes from oil and gas prices as well as potential supply issues with agricultural products. According to the World Bank, it is estimated that oil price hikes will lower the economic growths of China, Indonesia, South Africa, and Turkey by one percentage point. The same report mentions that the effects could be much higher for Turkey and South Africa. Considering Turkey’s inflation skyrocketed to 54%, food, fuel, and electricity prices will exacerbate Turkey’s poor economic conditions. In addition, Jordan, Lebanon, and Tunisia, which provide electricity subsidies to firms in their countries, will struggle with escalating oil price hikes. Countries already on the brink of economic meltdown such as Lebanon will be hit the hardest.

Europe’s dependency on energy and the increasing gas prices around the world forced the developed countries to look for alternatives. The initiative of President Biden of the US to increase oil production among OPEC members seems to be insufficient. After having talks with Saudi Arabia and Venezuela to increase oil production so that prices would go down, OPEC members declared that their agreement with Russia will continue and the OPEC decision will be out of politics. This implies that the world will continue to live under higher oil, gas, and electricity prices for some time to come.

Wheat and Grain Market

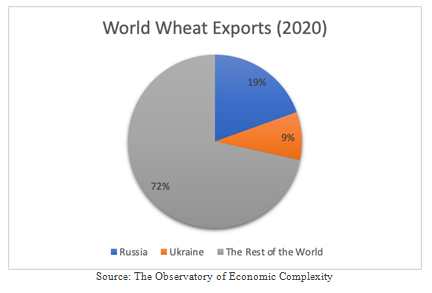

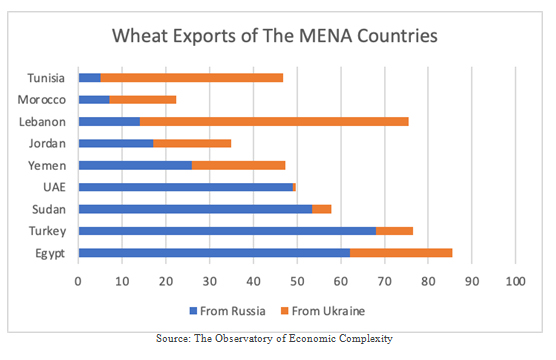

Russia and Ukraine provide 12% of the total calories consumed worldwide, derived mainly from wheat. They both provide more than 25% of the world’s wheat supply, making them the third global wheat exporter. However, this is strikingly higher and perhaps most concerning for the Arab world who consume approximately double the level of wheat than the rest of the world does. For example, Ukraine used to send 40% of its wheat and maize exports to the Middle East and North Africa (MENA). Altogether wheat exports from Russia and Ukraine made up 50% of the overall wheat supply in the Arab world, according to the Arab reform initiative. Countries such as Lebanon, Tunisia, and Egypt who rely the most on Russian and Ukrainian wheat may quickly find themselves struggling to supply foods that are central to their diet, pushing more people in those countries under the poverty line. It cannot be ignored that the likes of Lebanon and Tunisia are already under economic turmoil and these extra pressures will only serve to weaken them even more economically.

The figure below shows the wheat dependence of MENA countries on Russian and Ukrainian wheat imports.

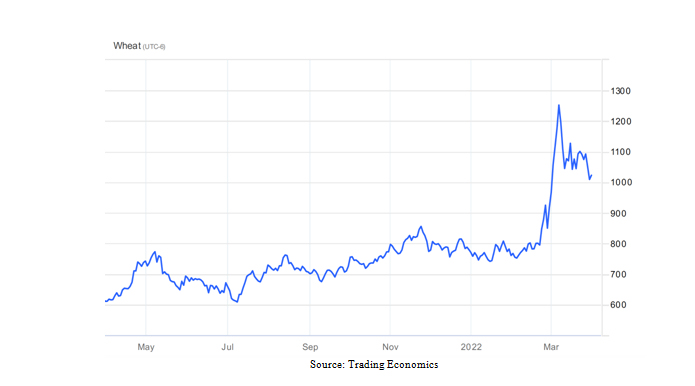

Also, the figure below shows how wheat prices jumped to over $1200 per bushel (approx. 25kg) from $600 per bushel since the invasion started. Wheat prices have fluctuated around $1000 recently and this puts extra pressure on wheat importers in the MENA region.

Source: Trading Economics

Lastly, Russia supplies titanium, aluminium, nickel, chemical gases, essential semiconductors, and metal production ingredients, globally too.

Future Implications and Conclusion

The world’s economic order has been changing fast. When the pandemic hit the world, economic output declined while unemployment increased. The pandemic was coming to an end (at least for richer nations), and now another crisis has come to shake the world, namely the Russia-Ukraine war. However, the economic impacts are expected to be milder compared with the pandemic and reorganising of global powers and camps could limit the economic fall out of the war. The US-led West and NATO are on one side, whereas Russia and China are on the other. Our political and economic lives will depend on the length and direction the war takes and global re-ordering. Whilst there is usually anger strong rhetoric and actions at the outset of a local war, these tend to subside over time as public interest starts to disappear.

However, there are some conclusions to draw from the unexpected war that began last month:

Firstly, Putin and the Russian economy have been isolated. The US has exerted its leadership over NATO and the EU. This will undoubtedly lead to increased military spending across Europe, which will mean cuts in public spending in other sectors of the economy such as welfare.

Secondly, the influx of millions of refugees across Europe will undoubtedly, have economic and social impacts on those countries taking in large numbers and particularly across the EU.

Thirdly, the economic repercussions that these sanctions will have, for those countries that depend on wheat and grain from Ukraine and Russia, particularly across the developing and/or Muslim world, could mean food insecurity, leading to political instability and turmoil. Some oil producing countries will undoubtedly receive windfalls in oil revenues. European countries will also see the effects of the war through higher costs for oil, energy, food prices , yet it may be easier for them to deal with this surge in price in contrast to economically weak countries because they have the resources and the capabilities to do so.

Lastly, another reality that we have experienced from this crisis has been the bias that the mainstream media has shown in responding to the call of those in need that are ‘close to home’ whilst having for long periods of time ignored the plight of those in the likes of Palestine, Afghanistan, Syria, Yemen, Somalia, Myanmar, and the list continues. The economic plight of these countries is also grim.

For the Muslim world that has suffered the most in terms of conflict in the past decade, this may be disheartening but it can also be seen as an opportunity for new alliances to be made and re- consider trade dependencies. The countries that previously relied heavily on Ukrainian and Russian imports have now been forced to reconsider their trade patterns. It is time that the Muslim world start producing their own economic products within, instead of creating dependencies elsewhere. At present, Pakistan is the 8th biggest producer of wheat in the world and Afghanistan has the potential to excel in this too, with wheat making up most of its grain produce. We saw with the boycott of Qatar by other Gulf states how they successfully started to produce key staple foods locally.

However, regardless of the outcome, the crisis- and the economic issues that have emerged from the Russia-Ukraine war, presents serious challenges but also opportunities for change. Each country will have to face up to its own challenges.

Fatih Kırşanlı & Hana Efendić are Research Associates at the Ayaan Institute in the Trade and Economics Unit.

Leave a Reply